These Habits Can Make You a Millionaire (And Many of Them Are Free!)

“Wealth comes to those who take small habits seriously.”

Introduction

Have you ever wondered how ordinary people create extraordinary wealth?

The truth is that the secret to becoming a millionaire is not hidden in a secret formula, but in small everyday habits.

In this article, we will learn 10 amazing habits that can not only make you financially independent, but also make the path to becoming a millionaire easier – and many of these are completely free.

Why is it important?

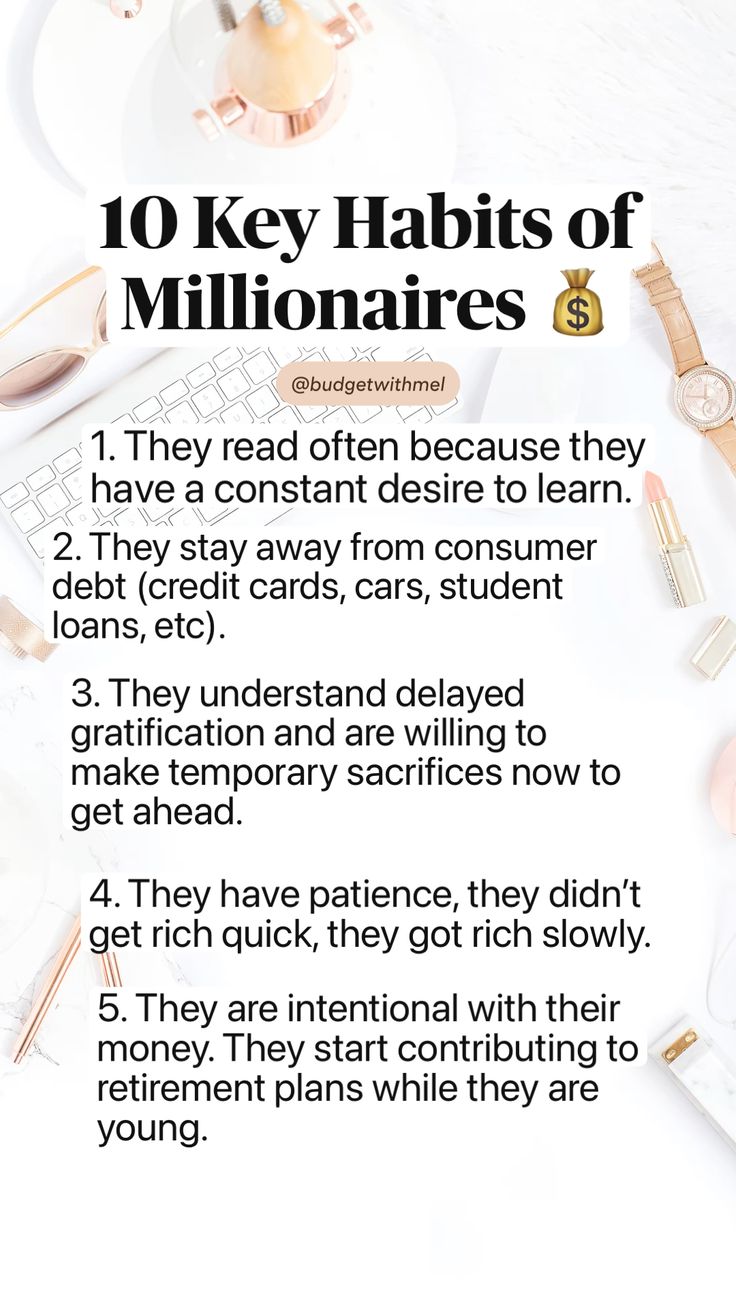

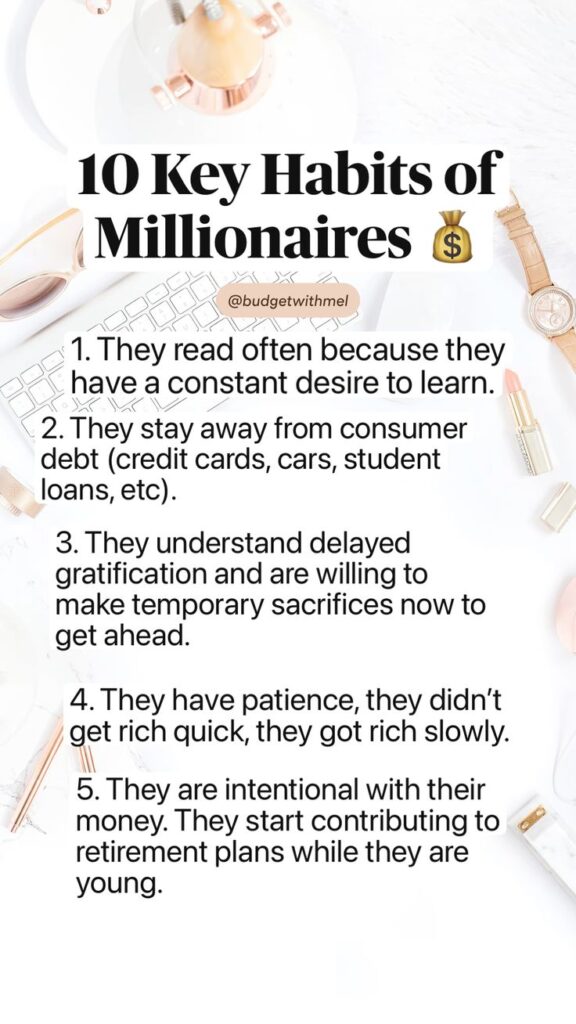

Increase self-study and financial knowledge

– Understanding investments, savings, taxes, loans – is a must for everyone.

What to do?

Read 1 financial book every week.

Watch channels like “Finance for beginners” on YouTube.

Understand the depth of words like investment, stock market, SIP.

Result: You will become the owner of money, not a slave of money.

- The habit of “saving first, then spending”

Wealth is created not by a big salary, but by big thinking.

Make it a habit:

As soon as you get your salary, set aside at least 20-30% for savings/investment.

Spend only the remaining money.

With this habit, you are creating an ‘economic asset’ every month.

- Understanding and taking advantage of compounding

“Compound Interest is the 8th wonder of the world.” – Albert Einstein

What to do?

If you invest even ₹5000 at 12% return for 25 years, it can become more than ₹1 crore.

How to make a habit?

Start SIP (Systematic Investment Plan).

The sooner you start, the more profit.

- Develop long-term thinking

Make it a habit:

Make any investment with a view of at least 5-10 years.

Stay away from ‘get rich quick’ schemes.

Patience is the biggest investment.

- Question every expense (Mindful Spending)

How to make a habit?

Ask before every expense: “Is this necessary?”

Review all expenses at the end of the month.

Tools:

Money Manager App

Excel Sheet Budget Template

With this habit, you can save ₹10,000–₹50,000 annually.

- Setting and tracking financial goals

Examples:

₹5 lakh emergency fund in 5 years

₹20 lakh house down payment in 10 years

₹1 crore retirement fund in 25 years

What to do?

Fix monthly investment for each goal.

Evaluate every 6 months.

Investment without a goal is like a sailor without a boat.

- Learning “High Income Skills” (possible for free too)

What are High Income Skills?

Digital Marketing

Coding / Web Designing

Graphic Design

SEO Writing / Freelancing

Financial Consulting

Where to learn?

YouTube (Free)

Coursera, Udemy, Skillshare

Government portals like SWAYAM

With these skills, you can start side income and increase savings.

- Self-control and control over desires

“Rich people are not those who can buy everything, rich people are those who do not need anything!”

How to develop this habit?

Stay away from sales, offers and unnecessary shopping

Don’t get influenced by social media

Learn to postpone “Delay Gratification” i.e. desires

This habit makes the mind strong and the wallet safe.

- Reinvest the money you get from every source

Like:

Bonus

Tax Refund

Side Income

Returns or Cashback

Every extra penny can become your wealth if you invest it instead of spending it.

- Insurance and emergency fund: The habit of protection from risk

Why is insurance necessary?

A serious illness or accident can wipe out all your savings.

₹1 crore term insurance is possible for ₹500–₹800/month.

Emergency Fund:

Keep a fund equivalent to at least 6 months of income in FD or savings account.

This will ensure that your investment plans do not stop in case of any disaster.

Bonus Habit: Review these habits monthly

Ask yourself every month:

How much did I invest this month?

Did I spend anything unnecessary?

Is my financial situation getting better than before?

Self-Audit will help you monitor your financial growth.

Small Example: Path to becoming a crorepati in 25 years

Monthly Investment (₹) Year Annual Return (%) Estimated Value (₹)

₹10,000 25 12% ₹1.76 Crore+

₹15,000 25 12% ₹2.64 Crore+

If you invest even ₹5000 initially and increase it every year, you can definitely become a crorepati in 20-25 years.

Conclusion

“Habits determine our destiny.”

You can turn your dream of becoming a crorepati into reality if you:

Choose the right habits

Follow them with discipline

And have patience over a long period of time

Many of these habits are absolutely free, but their value is priceless.

Choose a habit today and make tomorrow better.